Governance 2.0 - The big one

We identified a few issues with our current governance:

It takes time

Several may argue that some aspects of the early allocation of REP (non-transferable voting power/reputation) were not optimal, as some of it was based on capital. Even if we manually selected the initial distribution, it would be far from perfect, and it has taken us almost two years to expand our distribution into what is today an immaculate distribution (at least to us). For most DAOs, this is simply not a viable option.

Limited decentralization & opinion

Although we have plenty of differing opinions as a DAO as is, they are ultimately biased. When only employees can vote, they will naturally vote in favour of workers, which appears to be a good thing on the surface. However, concerns occur over time as some essential viewpoints are overlooked and underrepresented, potentially harming decentralization. We are very fortunate to not rely whatsoever on VCs for our current treasury, however, that doesn’t mean that there are no other stakeholders other than REP holders.

What about token holders?

It can be difficult to make DXD token holders happy when they are not directly involved in the governance process. Of course, selling a governance token was never the idea and goes against everything we believe in when it comes to good governance, but the difficult question remains: what good is the DXD token if it doesn’t have any voting power?

What Governance 2.0 does

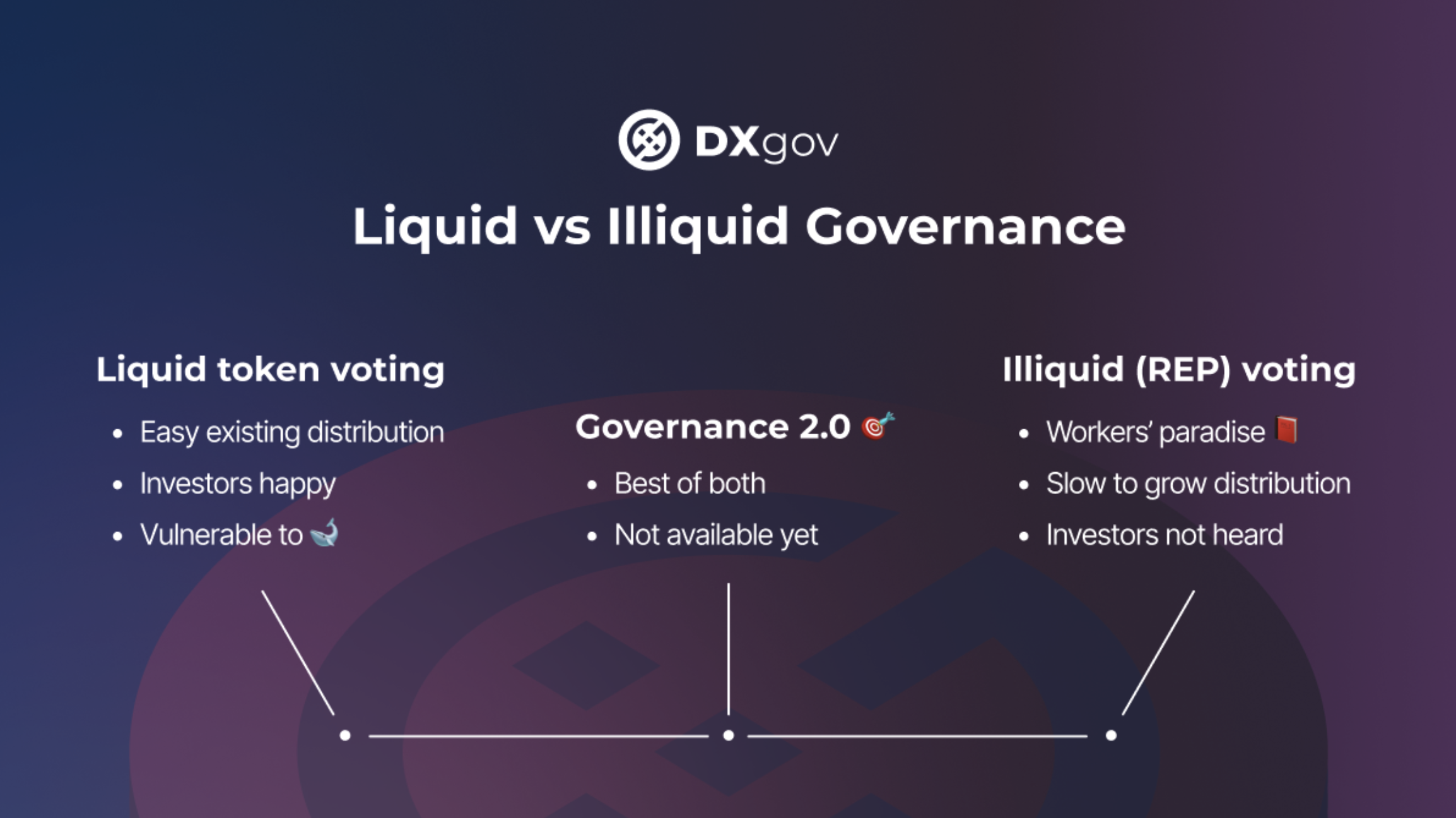

The main aim of governance 2.0 is to unite both the contributors earning non-transferable power along with the investors and economic backing of a project. By creating a voting power formula that combines both REP and staked ERC20, as well as some mechanisms to restrict abuse by whales, we gain the best of both worlds.

- New voting power formula

- Additional security

- Bounded ranges for DXD and REP influence

- Dynamic influence weighting

- Minimum requirements for both parts of voting power

- Supporting upgrades to architecture (WalletSchemes)

- DXD staking

- REP decay

- More voting incentives

- New ways of earning REP

- Easier creation and forking of Governance 2.0 DAOs

We believe that this governance model will serve as a bridge, allowing more projects to benefit from reputational governance and holographic consensus. As a larger portion of governance will organically increase over time, the hard start and base distribution become minor issues.

If you would like to read more about the specifics of how we aim to do this please read more Here

Before we launch, some of this is subject to change.